It seems the oldest trick in the book still holds true: the easiest way to rob a bank is to own one. Utter chaos is how the situation in the crypto industry is being described.

Since the market got its first whiff that the world’s second-largest cryptocurrency exchange, FTX.com, was on the brink of collapse, much has come to light about the company’s now-disgraced founder Sam Bankman-Fried (SBF).

Dubbed “The Devil in Nerd’s Clothes” by Forbes, SBF is accused of using FTX’s customers’ money to fund the company’s trading arm, Alameda Research, to make highly leveraged (risky) trades behind closed doors. And as a result, subsequently lost FTX users’ funds — all without their permission. And even worse — publicly lied about it.

FTX’s terms of service explicitly state that user funds are not permitted to be used for trading by FTX: “None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading… Title to your Digital Assets shall at all times remain with you and shall not transfer to FTX Trading.”

- Advertisement -

All of this led users to believe their funds would be backed 1-to-1 on the FTX exchange; safe, secure, and not used by FTX for trading purposes behind closed doors. This — as it turns out — was all a lie.

Reuters revealed earlier this week that Alameda and FTX executives knew about the misappropriation of FTX user funds. A revelation that has shaken the crypto industry to its core. FTX has since filed for U.S. chapter 11 bankruptcy protection, with SBF subsequently stepping down as CEO — pending a criminal probe by US law enforcement.

‘Worse than Madoff’

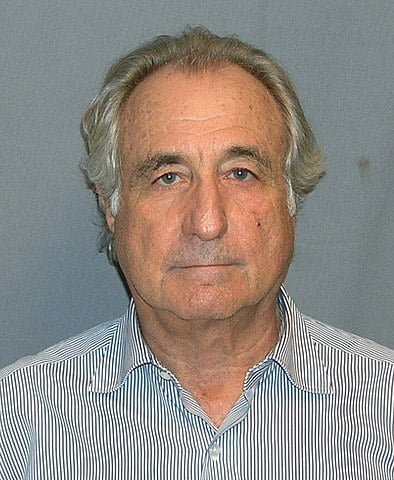

John Reed Stark, a lecturing fellow at Duke University Law School, told Yahoo Finance last Friday “it’s Walking Dead like anarchy,” in response to FTX’s collapse. “This is worse than Theranos, this is worse than Madoff,” he added. Referring of course to infamous fraudster Bernie Madoff and convicted Theranos fraudster, Elizabeth Holmes.

Although Madoff defrauded a whopping $65 billion from investors, a far greater amount than FTX, what’s most concerning is the types of investors SBF managed to swindle.

“Because in this case, you’re dealing with all sorts of investors… These are supposed to be some of the most sophisticated people in the world… The contagion is quickly, rapidly, spreading amongst all the various crypto ecosystem.” — John Reed Stark.

Former U.S. Treasury Secretary Larry Summers told Bloomberg “I would compare it with Enron.” Referring of course to the 2001 scandal that lost investors billions, after it was discovered the company had fraudulently overstated their revenue.

What’s more, the recent FTX “hack,” which saw $400 million USD drained from users’ accounts just prior to FTX’s bankruptcy announcement, is likely to be an inside job, the Financial Review reports. Similar to all high-profile financial crime cases — there is always a political element.

As it turns out, SBF was one of the biggest Democratic party donors going into this year’s U.S. mid-term elections. Altogether he donated a whopping $69 million, Forbes reports. “Much of that money likely ended up supporting candidates favourable to FTX and the cryptocurrency industry in general.”

- Advertisement -

All in all, this scandal has the potential to not only significantly disrupt the private sector but the U.S. government, too. White House Press-secretary Karine Jean-Pierre made a statement last Thursday in response to FTX’s collapse, saying “without proper oversight, cryptocurrencies risk harming everyday Americans.” “The White House will closely monitor the situation as it develops.”

What now?

As the FTX collapse continues to unfold, investors of all types have been left holding the bag. Bankruptcy cases can take years — and sometimes decades — to resolve.

Legendary businessman and early-stage FTX investor, Kevin O’Leary, told CNBC that he doesn’t see any more institutional money being thrown into the industry until “this stuff gets regulated.” The big money has been scared away — and rightly so.

What’s the key lesson to all crypto investors? If your bag is held on an exchange — it does NOT belong to you! Unfortunately, fraud and immorality will continue to plague the industry until regulation catches up.

The best way to protect yourself and your crypto is by using a hardware storage wallet. This is the only way to truly own your assets.

We recommend using the Ledger Nano X — the most secure hardware wallet for storing your crypto. Please note: this is an affiliate link. If you choose to purchase something, CONTX Media will receive a small commission.

Remember to stay safe out there and protect yourself at all times.